A State-by-State Guide To Property Taxes: Understanding The Landscape

A State-by-State Guide to Property Taxes: Understanding the Landscape

Related Articles: A State-by-State Guide to Property Taxes: Understanding the Landscape

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to A State-by-State Guide to Property Taxes: Understanding the Landscape. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

A State-by-State Guide to Property Taxes: Understanding the Landscape

Property taxes, a cornerstone of local government funding, represent a significant financial obligation for many homeowners and property owners. This guide provides a comprehensive overview of property taxes across the United States, exploring their complexities and variations from state to state.

Understanding the Basics

Property taxes are levied by local governments, typically counties or municipalities, on the assessed value of real estate. This value is determined by assessors who evaluate the property’s market worth. The tax rate, expressed as a percentage or per thousand dollars of assessed value (mils), is set by the local government to fund essential services like schools, fire departments, police, and infrastructure.

Navigating the State-by-State Landscape

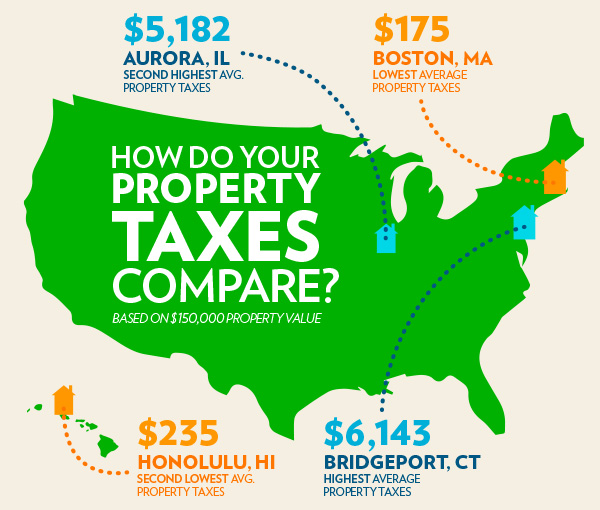

Property taxes vary widely across the United States, influenced by factors like local economic conditions, property values, and government priorities.

A Visual Representation:

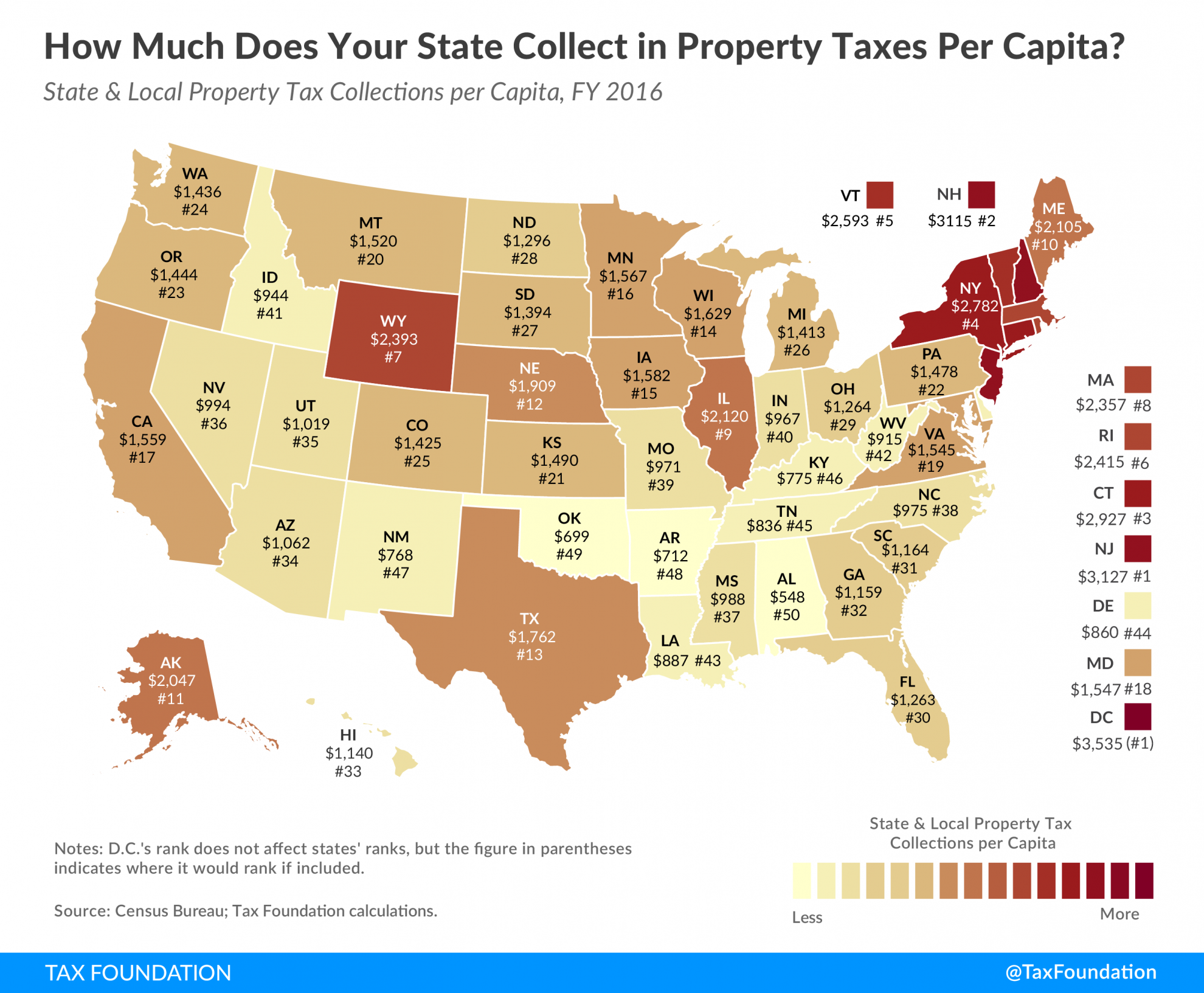

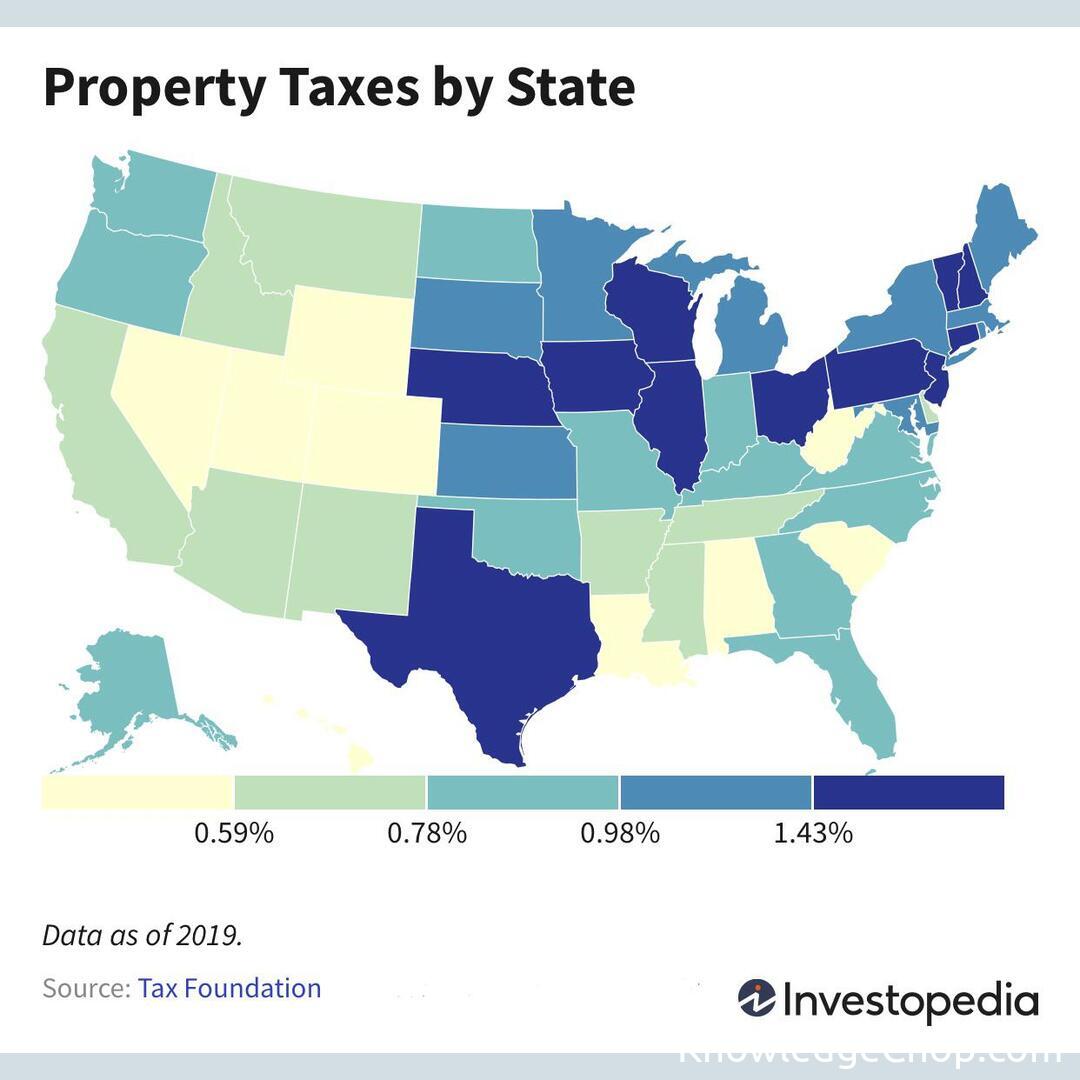

To better understand the geographical distribution of property tax rates, a map depicting the average effective property tax rate for each state can be a helpful visual aid. The map would use color gradients to illustrate the range of rates, from lowest to highest.

Key Insights from the Map:

- High-Tax States: States with the highest average effective property tax rates typically cluster in the Northeast and Midwest, with states like New Jersey, Illinois, and New Hampshire topping the list.

- Low-Tax States: States with the lowest average effective property tax rates are often found in the South and West, with states like Hawaii, Alabama, and Wyoming leading the way.

- Regional Variations: While the map provides a general overview, it’s crucial to note that significant variations exist within states. Urban areas tend to have higher property tax rates than rural areas due to higher property values and greater demand for public services.

Factors Influencing Property Taxes

Several factors contribute to the wide variation in property tax rates across states:

- Property Values: Higher property values generally lead to higher property tax revenue, allowing local governments to levy lower tax rates while maintaining similar revenue streams.

- Local Government Spending: The level of public services provided by local governments, such as education, public safety, and infrastructure, directly impacts property tax rates.

- Tax Base: The number of taxable properties within a jurisdiction influences the tax rate. A larger tax base allows for lower tax rates to generate the same revenue.

- Property Tax Caps: Some states have implemented property tax caps to limit the amount of tax that can be levied on a property. This can help stabilize property taxes and provide predictability for homeowners.

- Exemptions and Credits: Many states offer property tax exemptions or credits to certain individuals or groups, such as seniors, veterans, or low-income homeowners.

The Benefits of Property Taxes

Property taxes play a crucial role in funding local government services, providing numerous benefits to communities:

- Funding Essential Services: Property taxes are the primary source of revenue for most local governments, enabling them to provide essential services like education, public safety, infrastructure, and parks and recreation.

- Local Control: Property taxes empower local governments to make decisions about spending priorities and service levels, fostering a sense of local control and accountability.

- Fiscal Stability: Property taxes provide a stable source of revenue for local governments, helping to ensure the long-term financial stability of communities.

- Economic Development: Well-funded local governments can invest in infrastructure, education, and public safety, attracting businesses and fostering economic growth.

FAQs about Property Taxes by State Map

Q: What are the highest and lowest property tax rates in the United States?

A: The highest average effective property tax rates are generally found in the Northeast and Midwest, with states like New Jersey, Illinois, and New Hampshire leading the way. States with the lowest average effective property tax rates are often found in the South and West, with states like Hawaii, Alabama, and Wyoming topping the list.

Q: How do I find my property tax rate?

A: Your property tax rate is determined by your local government, typically the county or municipality. You can contact your local assessor’s office to obtain information about your property’s assessed value and the applicable tax rate.

Q: What are some ways to reduce my property taxes?

A: There are several ways to potentially reduce your property taxes, including:

- Appealing Your Assessment: If you believe your property’s assessed value is inaccurate, you can appeal the assessment to the local assessor’s office.

- Taking Advantage of Exemptions: Many states offer property tax exemptions for certain individuals or groups, such as seniors, veterans, or low-income homeowners.

- Participating in Tax Relief Programs: Some states offer tax relief programs for homeowners facing financial hardship.

Tips for Navigating Property Taxes

- Stay Informed: Regularly review your property tax bills and understand how they are calculated.

- Monitor Local Government Budgets: Be aware of how local governments are spending property tax revenue and participate in public hearings or meetings.

- Consider Property Tax Planning: If you are planning to buy or sell property, consult with a tax professional to understand the potential tax implications.

Conclusion

Property taxes are an integral part of the American tax system, playing a vital role in funding essential local government services. While property tax rates vary significantly across the United States, understanding the factors that influence these rates and the benefits they provide can help homeowners and property owners navigate this complex aspect of homeownership.

Closure

Thus, we hope this article has provided valuable insights into A State-by-State Guide to Property Taxes: Understanding the Landscape. We hope you find this article informative and beneficial. See you in our next article!

You may also like

Recent Posts

- A Geographical Journey Through The Republic Of Congo: Unveiling A Nation’s Landscape And Potential

- Navigating Iowa’s Roads: A Comprehensive Guide To The Iowa DOT Road Condition Map

- Navigating Moreno Valley: A Comprehensive Guide To The City’s Layout

- The Power Of Maps: Understanding The Role Of Map Servers In The Digital Age

- Mastering The Battle Royale: The Importance Of Warm-Up Maps In Fortnite

- A Comprehensive Guide To Printable State Maps: Unveiling The Power Of Visualization

- The Missouri River: A Vital Lifeline Across The American Heartland

- Deciphering Nevada’s Political Landscape: A Guide To The Silver State’s Electoral Map

Leave a Reply